Achieve Unprecedented Trading Efficiency with FIX Connector

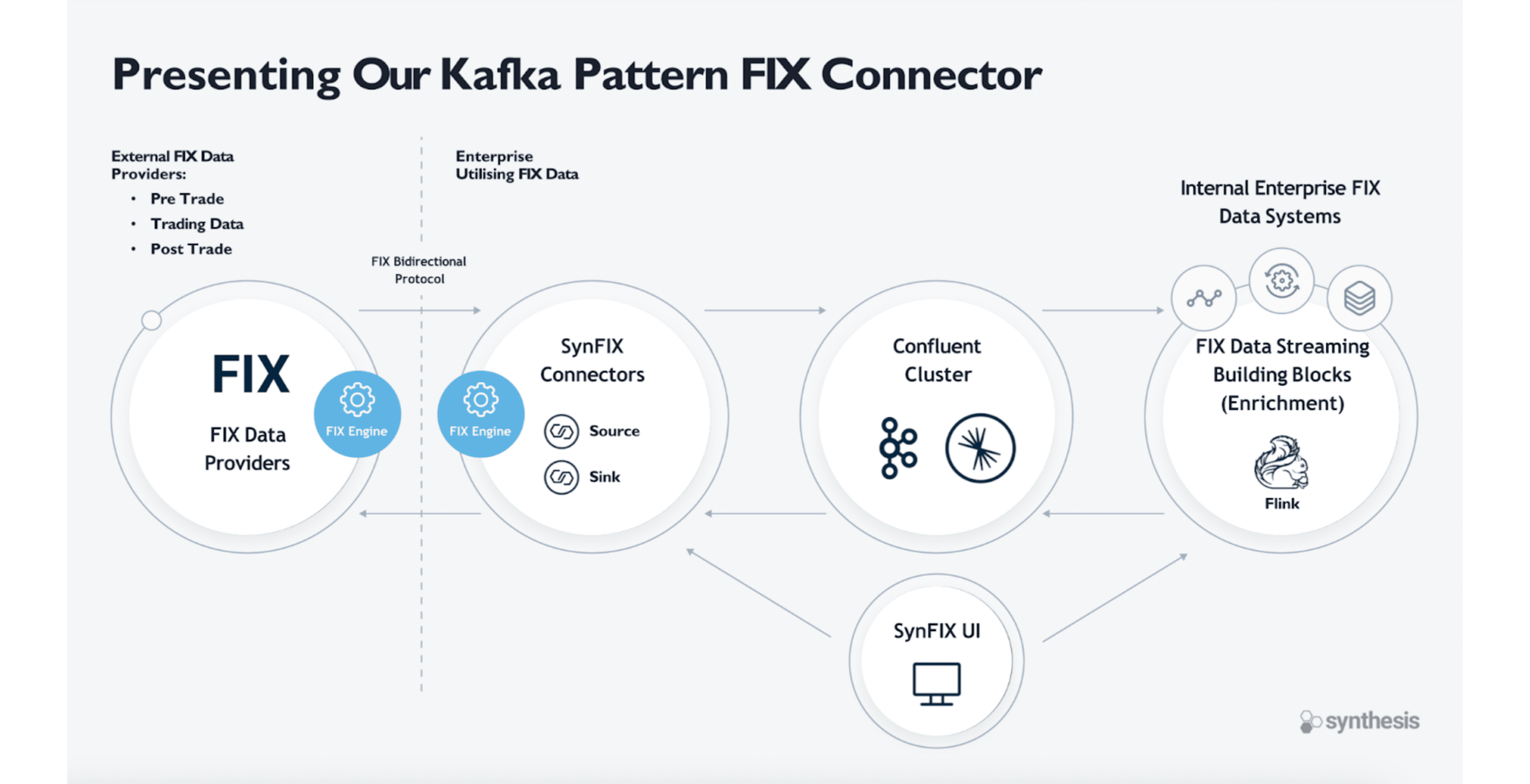

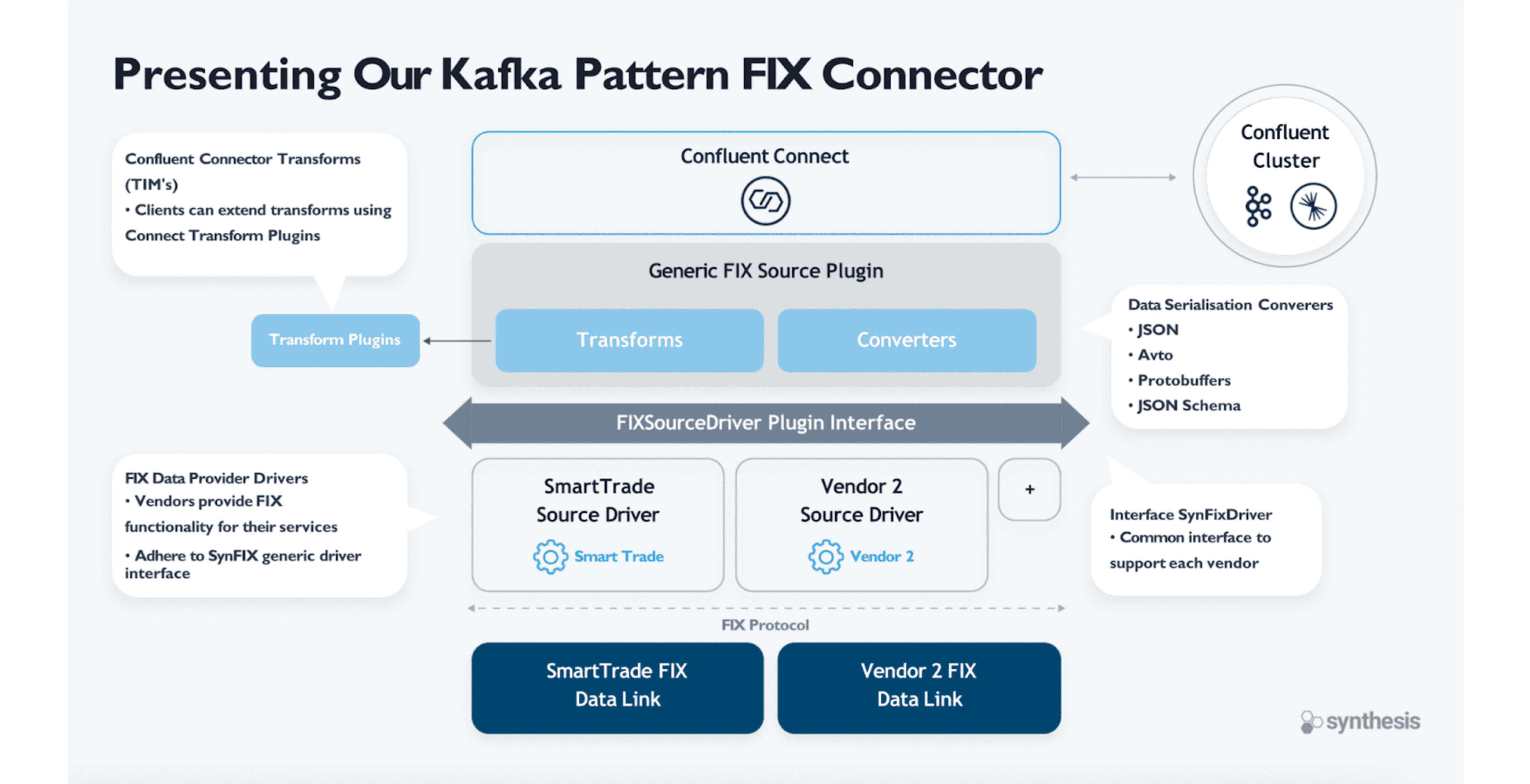

Synthesis developed the FIX (Financial Information eXchange) Connector, which streamlines the integration process with various financial entities. It addresses the growing demand for real-time, high-frequency intraday data essential for regulatory compliance and risk management.

"The ability to quickly and efficiently connect to new liquidity providers, exchanges, or data sources could give trading operations a substantial edge, providing them with faster access to market data and order execution capabilities.” - Mike Stephanou, Rand Merchant Bank.

Connect Your Trading Ecosystem with Our FIX Engine

In the trading world, speed is of the essence; even minor delays can result in missed opportunities or financial losses.

To tackle these challenges, the Confluent FIX Connector has been designed to enable seamless, real-time data integration across different asset classes, simplifying the addition of new FIX data sources and accelerating the integration process.

FIX Connector Benefits:

Enhanced scalability

Efficiency

Easing the load on specialized staff

Build with Confluent

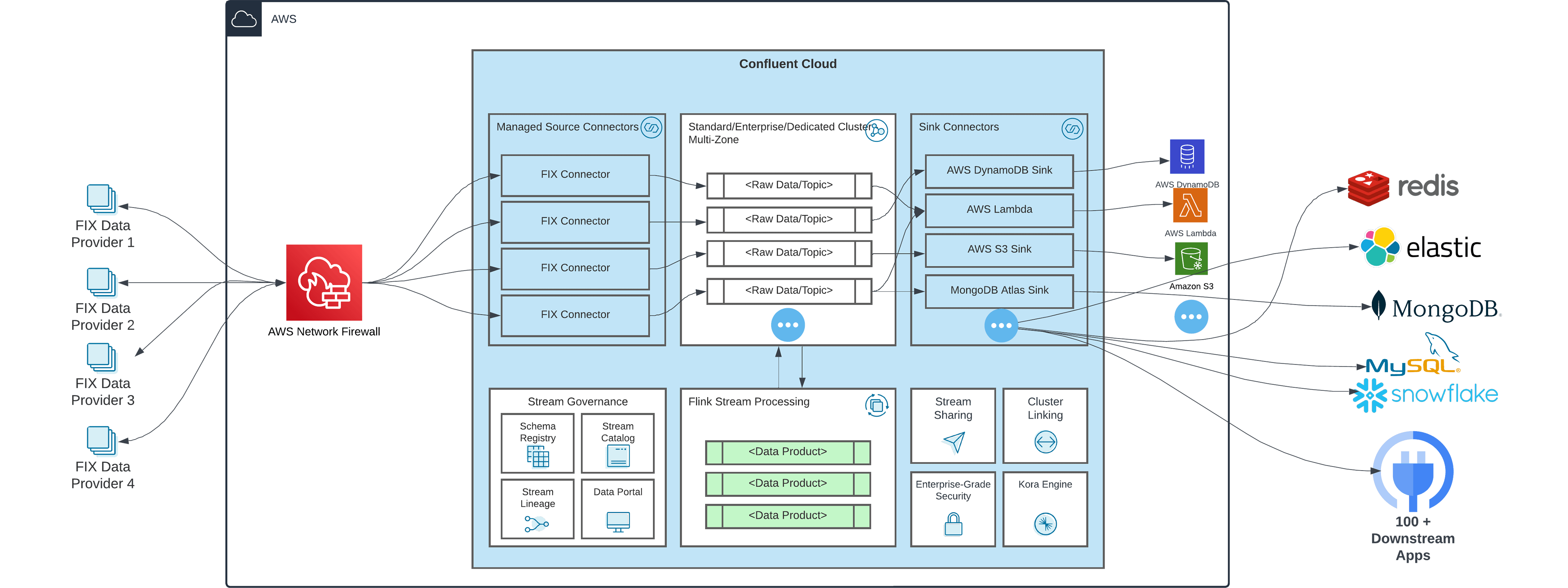

This use case leverages the following building blocks in Confluent Cloud:

Reference Architecture

Resources

Contact Us

Contact Synthesis to learn more about this use case and get started.