[Live Demo] Tableflow, Freight Clusters, Flink AI Features | Register Now

Real-Time Insurance Quotes Made Easy

Leverage streaming to perform real-time risk assessment and calculations across a variety of data sources. Provide instant, accurate quotes with ultra-personalized discounts to drive greater customer growth and revenue.

Instantly Create Personalized Quotes with Stream Processing

Real-time data is crucial for modern insurance experiences – providing customers with the best prices, lightning-fast service, and most relevant products in a single click. Confluent’s data streaming platform gets data where it needs to be in real time, with stream processing to act on data in flight, while ensuring security and compliance to meet requirements of a highly regulated insurance industry.

Data streaming supports transformative use cases that help providers innovate faster in an increasingly digital-native Insurtech space.

Eliminate silos with real-time data integration between cloud-native platforms and legacy infrastructure and databases.

Enable real-time, data-driven fraud detection and prevention.

Shift from reactive to predictive analytics for dynamic pricing, claims prediction, and customer renewals.

Leverage machine learning-powered risk analysis to enable rapid underwriting decisions.

Build innovative new products and services such as an AI chatbot.

Govern and secure data to ensure compliance and ensure the right data is in the right place and right form for regulatory reporting.

Build with Confluent

This use case leverages the following building blocks in Confluent Cloud.

Reference Architecture

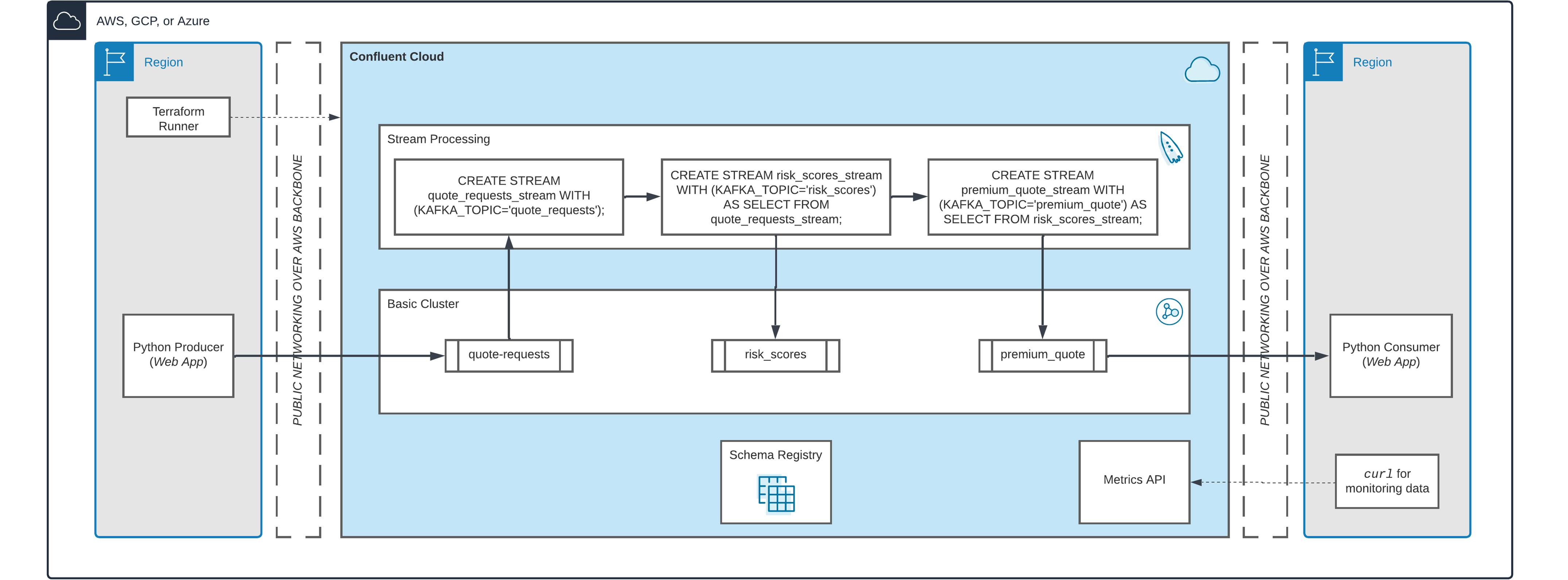

This reference architecture shows how Confluent Cloud can be used to capture real-time customer quote requests from an insurance web app, do stream processing to enrich data and analyze risk associated with insuring an individual, and immediately provide customers with accurate pricing.

From customer events on a web app to change data capture off a database to data from IoT devices and automobiles – data from any source can be written to topics in real time.

Enrich incoming customer data with reference data on home address neighborhood data (e.g., crime rates), vehicle info, local laws and regulations, etc. Leverage ML or an actuarial model to determine risk and calculate a weighted score and subsequent quote for insurance premium – all in near real time.

Populate a front-end with insurance quotes as well as stream enriched data to systems such as S3, Elasticsearch, and Snowflake for analytics, dashboards, and other use cases.